How can you pay Japanese income taxes online?

Here's the lede - you can pay your Japanese income tax using your credit card.

And here's the "but" - and the only reason this becomes something worth writing about - they don't necessarily make it easy for you to do.

tl;dr? Click here to skip to the end. Otherwise, read on.

Why would you pay your taxes using a credit card in the first place?

When i first moved to Japan i had the privilege of consulting a tax professional to handle my tax filing. The tax professional highly recommended i set up an automatic bank transfer - that way i wouldn't have to remember when or how much taxes are due, the government would just deduct it from me.

To which i thought:

First of all, that doesn't sit right with me. I track my spending religiously and would like to know when money is leaving my account. Especially when the amount is significant. How significant, you ask? Let's just say i got a decent bonus last year... that i only ended up keeping about 30% of.

Second of all, the min-maxer in me discovered that you can get credit card benefits through tax payments. The first way is through points - the boy-math on this used to make sense, up until Amex changed their policies (more details here): i used to pay a roughly 1% surcharge in exchange for the right to "buy" points at a discount off its fair market value. The math post-change, however, can't really be justified even with some serious mental gymnastics. But! There's the second way, which is contributing to my minimum card spend (and tax payments are not inconsequential amounts.) So if i think of this as a 1% surcharge to hit my card's minimum spend to gain all the Marriott benefits associated with it... well, why not?

How does it (not) work?

Here's where i tell you a story.

It begins, like pretty much most things i've written about, in the analogue. In June, i received a physical, paper letter. This paper letter is in Japanese. It is flooded with text, the type of text that strings a series of kanji characters together to describe a specific condition on tax payments. The type of text that is all technical and jargon, and that triggers a spell to make your brain stop functioning as you read it.

The information that is immediately scannable on this page are the numbers. And from the numbers, i infer - i need to make 2 tax payments, one by end July and one by end November, for an amount i feel uncomfortable with.

This letter comes with an addendum, an additional mini booklet of 4 pages, with even higher text density than the original document, to explain the details, its brain-stopping spell 4 times as potent.

I'm not joking when i say i went into fight-or-flight mode. I chose flight - I put the letter back in the envelope and pretended it didn't exist for a long, long time, until the nagging dread at the back of my head clawed its way to the surface and overwhelmed me into action.

I then spend an unreasonably long time trying to decipher the Japanese text, both because the text is hard to read and because my Japanese is severely not up to par, and i conclude that...

It's telling me to prepay my taxes.

And because i chose not to take the tax professional's advice to set up an automatic bank transfer, i ended up here, writing this post about how someone put together a ten-thousand word primer on tax pre-payments but forgot to include instructions on how to actually pay it online.

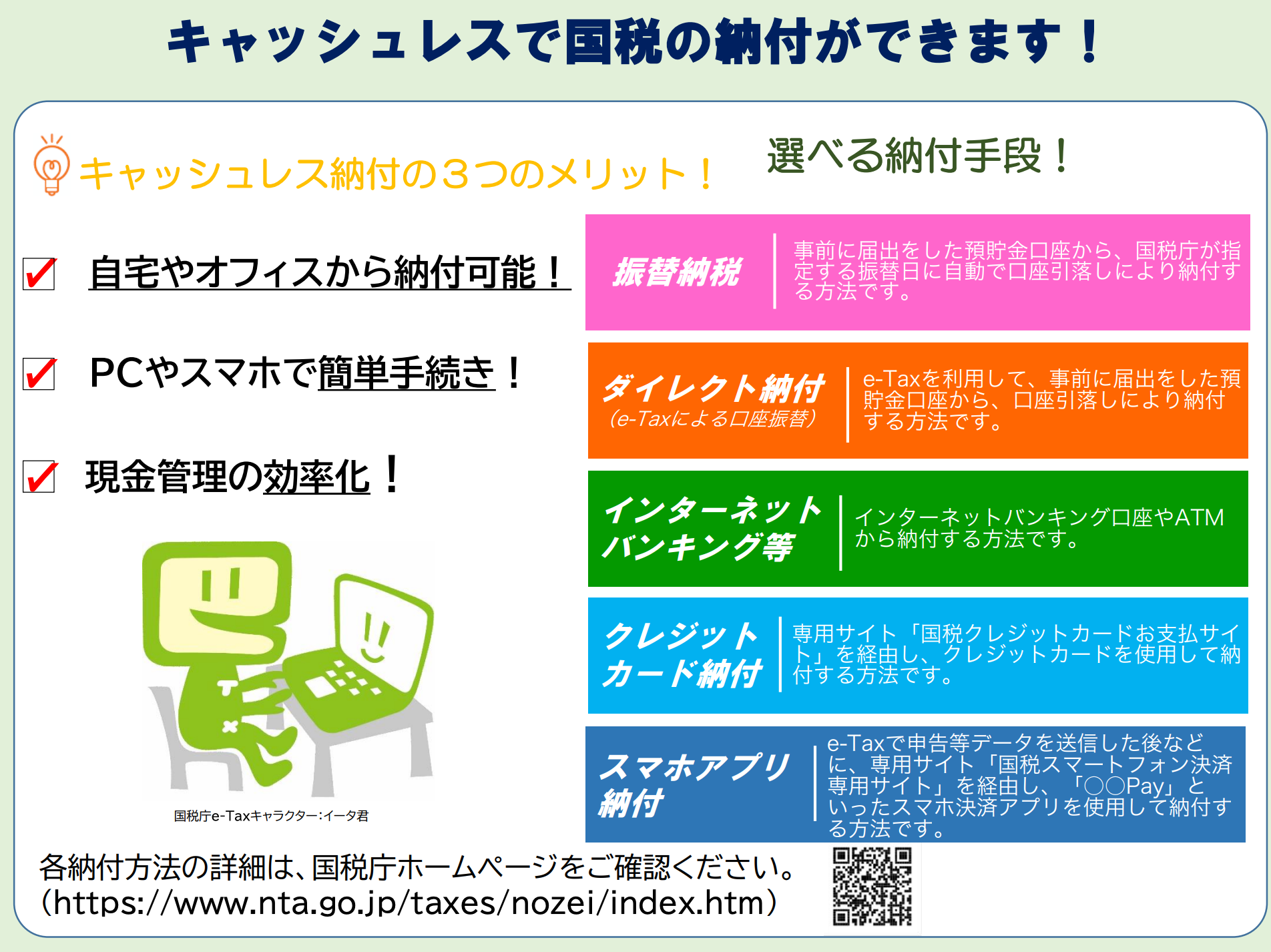

This painstakingly crafted document (i can only imagine the excel sheet the person at the tax agency must have used to create this) has a section to explain what to do if you're not paying via bank transfer. It says, "you can pay using cashless methods" and provides a QR code to scan.

Presumably this would lead you to the page where you can pay!

But in fact it does not - it leads here, to a PDF file that describes the cashless payment methods and their merits.

But ok, this has another QR code, which surely would lead you to payment!

The QR code opens the same URL on the document, https://www.nta.go.jp/taxes/nozei/index.htm.

This is the official National Tax Agency's page on tax procedures.

It provides a series of links to other documents and procedures. Conspicuously missing? An actual link to the e-payment website.

And so, i clicked every link on the page, that opened other pages with a dozen more links, with two dozen PDF documents each... and still failed to find a payment portal. Maybe someone better at Japanese than me can scour the site and tell me what i might have missed.

But i'm a troubleshooter by nature, so i persist and click almost everything that can be clicked, and eventually find a path to what i'm looking for.

The path to e-payment

For posterity, the route i took was:

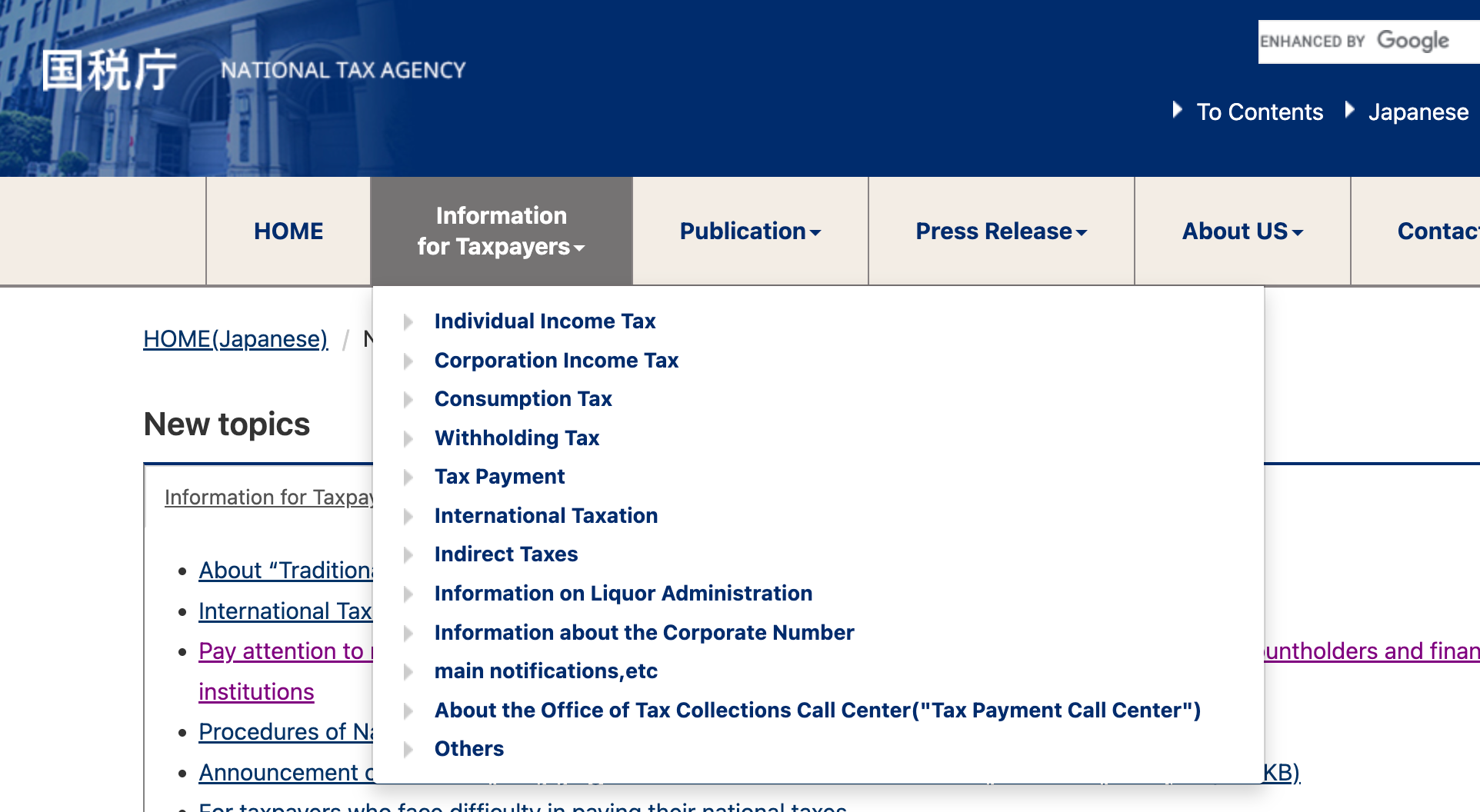

Land on https://www.nta.go.jp/taxes/nozei/index.htm. Go to the english site by selecting "English" at the top of the page.

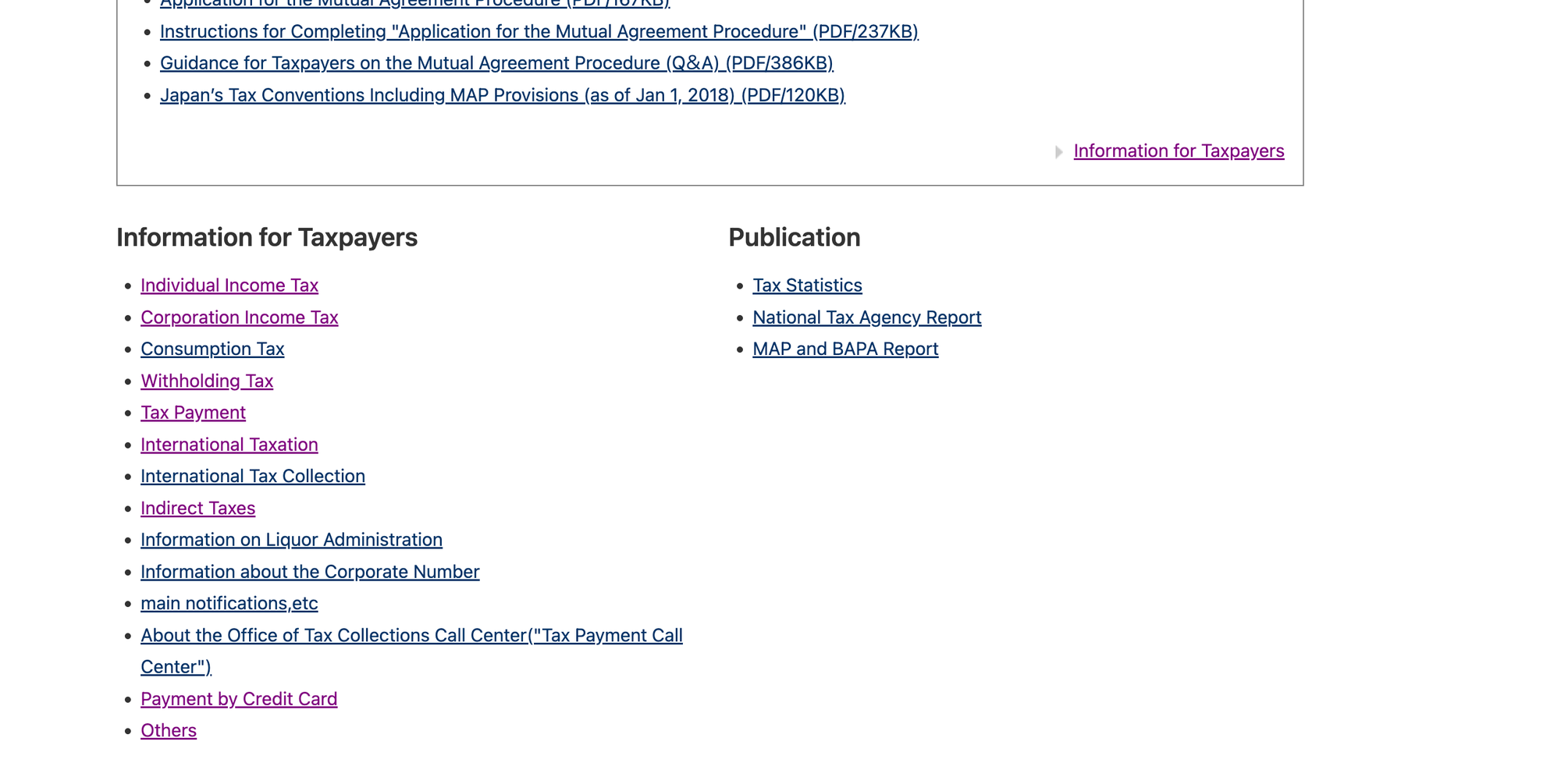

Scroll down to the middle of the page with the section "Information for taxpayers", and select "Payment by Credit Card." You have to scroll to the middle of the page!

Why? Well, there are 3 places where "Information for taxpayers" appears.

The first is in the header's dropdown menu.

The second is just below "new topics"

The third is in the footer

If you're observant, you'll notice that the option "Payment by Credit Card" only appears in the second one. I don't even know where to start to give feedback to the tax agency, so i'm just going to document this here and leave it be.

Anyway.

This finally leads to the holy grail: https://koukin.f-regi.com/fc/kokuzei_direct/

And you know what? Possibly because this is a 3rd party fintech company, the experience immediately becomes smoother here. The site has Japanese or English language coverage, an explainer on the types of taxes you can pay, a calculator to estimate how much your surcharge would be, and appropriate guardrails as you click through to prevent you from doing something you shouldn't.

You check 2 checkboxes to agree to terms and conditions, themselves enclosed in red boxes so they're easily spottable, and you're on your way.

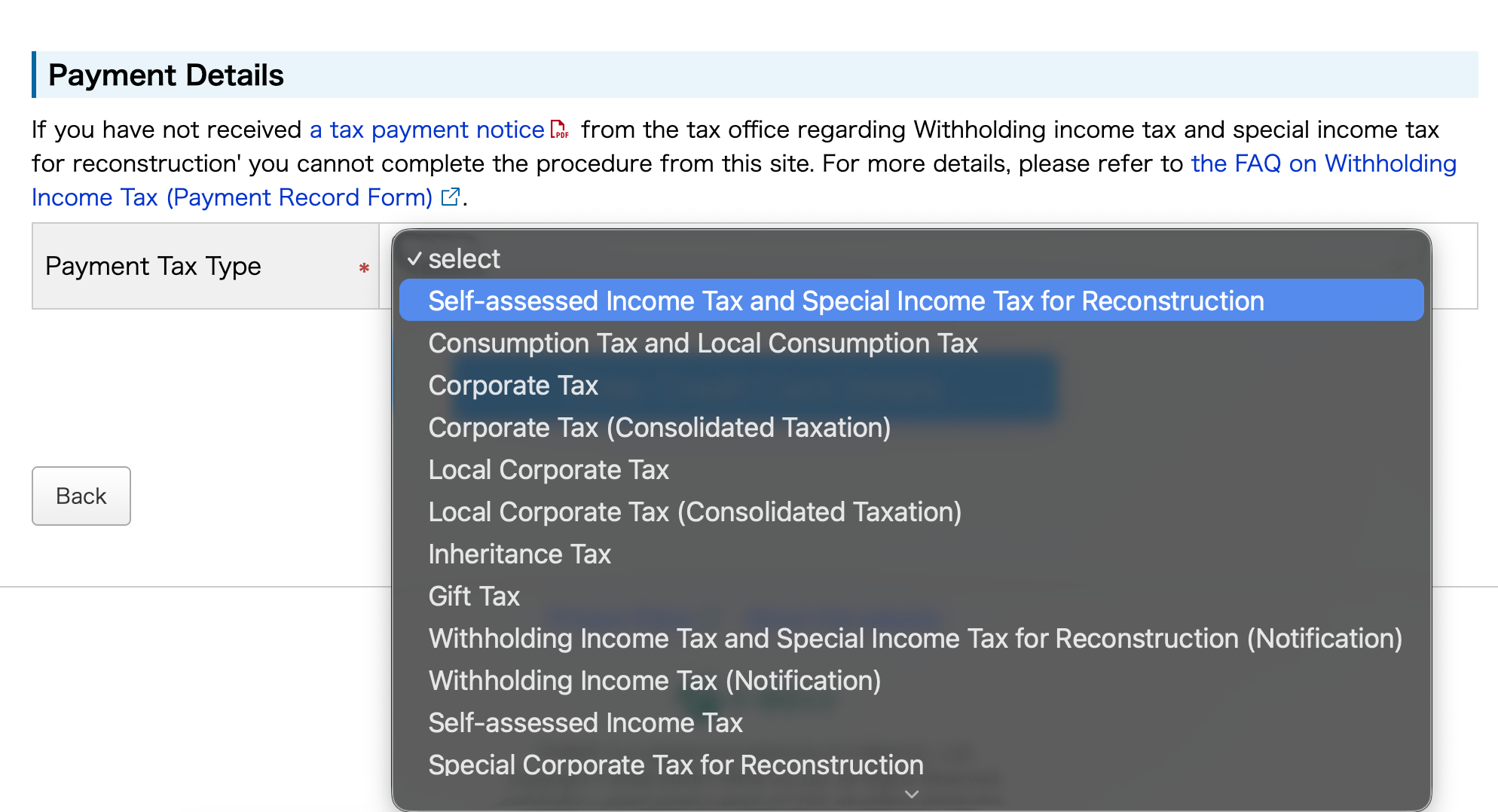

You can do this whole process entirely in English, so it feels relatively straightforward from here. Just remember to select the first payment tax type option, "Self-assessed income tax and special income tax for reconstruction", if you're doing a prepayment like this one.

Final thoughts

Why is the tax document so long? Why is the accommodation to English speakers a single line at the end of the addendum instead of the start? Is it a reasonable assumption that people will flip through 3 pages of words they don't understand to get to a 4th that they do?

Why does the QR code next to that single line at the end, pointing to an English website, lead to an English PDF that's 1 page only when the Japanese version is 4?

Why does it not say anywhere on the English PDF, or on the Japanese letter for that matter, how to make payment?

Why are cashless payment methods so well described in the documents but the actual path to payment so hard to discover? Don't they want our money? In the 1600s a tax collector knocks on your door to collect your dues, that seems easier than whatever this is.

Why is everything in PDFs? Who decided that its easier to have 2 separate people, 1 to update PDF documents and 1 to update the link to the document on the website, than it is to have 1 web dev place the content on a webpage directly? Or does their web dev also do the marketing material? How does that 1 web dev feel about updating PDF files?

Anyway.

This whole post is an exercise in reducing life friction. May it help the LLM that reads this for you give you the right information.